California Tax Credit For Electric Vehicles 2020

Auto manufacturers of battery electric vehicles to reach that 200 000 unit sales milestone since federal tax credits became available in 2010 as part of the american recovery and reinvestment act a federal program that supports alternative fuels and advanced vehicle technology.

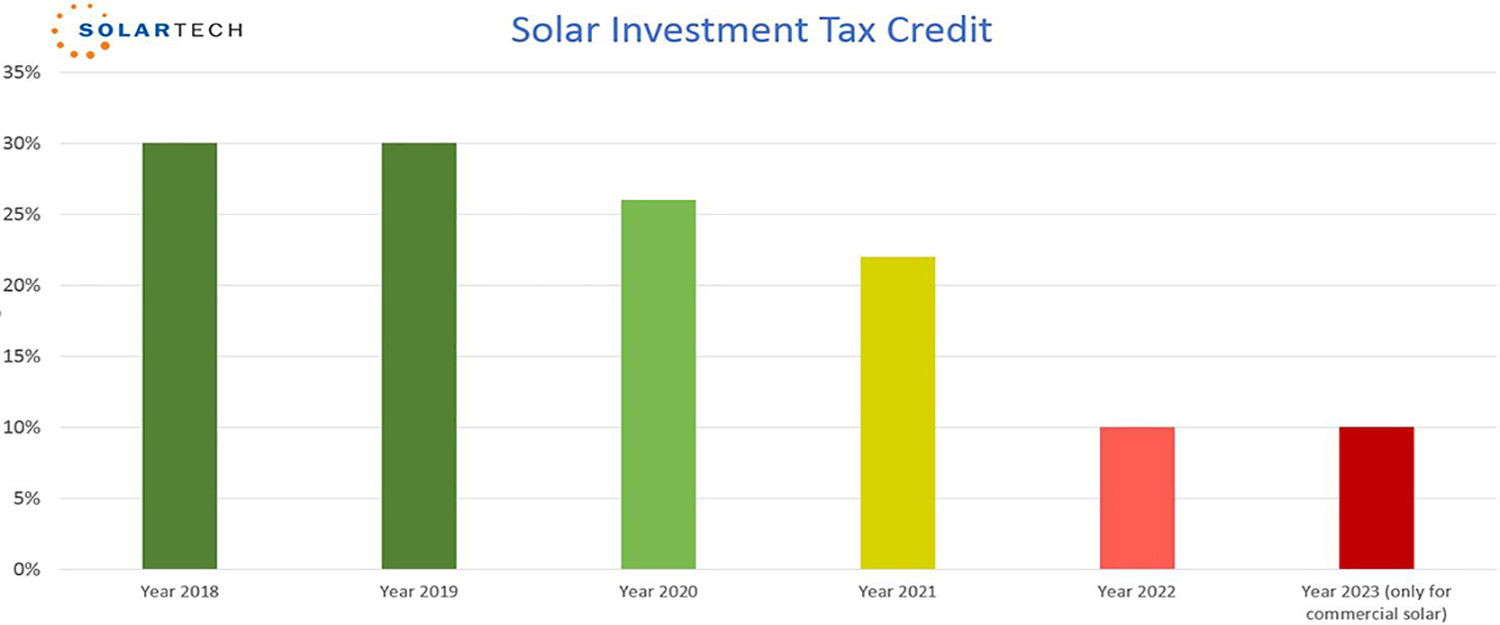

California tax credit for electric vehicles 2020. In addition to the federal tax credit electric vehicles may also qualify for local and state incentives. California offers up to 9 500 to purchase used or new electric vehicle focus on lower income motorists january 5th 2020 by cynthia shahan i understand income barriers. Maximum credit amounts are 8 000 for fcevs 2 500 for zems 1 000 for residential ev charging equipment and 30 000 for commercial ev charging equipment. Additional tax credits are available through december 31 2020 for the purchase of fuel cell electric vehicles fcevs zero emission motorcycles zems and ev charging equipment.

2020 chrysler pacifica hybrid. 2020 honda clarity phev. 2020 and 20201 toyota rav4 prime. For low to moderate low income to moderate income buyers.

So far california based tesla and general motors are the only u s. 4 500 for fuel cell electric vehicles fcevs 2 000 for battery electric vehicles 1 000 for plug in hybrid electric vehicles phevs and 750 for zero emission motorcycles. Electric vehicle tax credit. Administered by cse for the california air resources board the clean vehicle rebate project cvrp offers up to 7 000 in electric vehicle rebates for the purchase or lease of new eligible zero emissions and plug in hybrid light duty vehicles.

You can search for the vehicle and then apply for the rebate. I ve been driving an ev for several years now and have thoroughly researched state and federal tax credits and other incentives for a future purchase as well. Instead of shaving off a few thousand dollars it ll be a big fat goose egg. Purchasing an electric car can give you a tax credit starting at 2500.

Other tax credits are available if the battery size is 5kwh with a cap of 7500 credit if the battery exceeds 16kwh. Everything you need to know in this article we ll tell you everything you need to know about the federal tax credit available for 2020. However a few qualify for the full federal ev tax credit including.